Insights

Pools betting theory | Part 2

Syndicate captain and racing expert Matt Bisogno gives us the second part of his fascinating introduction to pools betting theory. To read his original article, you can click here or to read part one, click here.

Having already looked at the basics of multi-race bets and the key area of staking, the second part will focus on strategy and tactics in pools betting thoery. This will include what to consider when framing your bets and how to manage your position once your tickets are live.

When to play: Value Considerations in pools betting theory

Any day is a good day for pools betting from a fun perspective. Bets such as the Place 6 or Win 6 promise to keep a player engaged in a race meeting for as many as six races and for a smallish stake.

Colossus place pools have significant liquidity on a daily basis but they also have their share of sharp players. Because of the nature of multi-race place pools, where players typically have multiples chances per race, a big dividend often requires an unexpected result to occur in more than one race.

So, in order to play place pools properly, my pools betting theory is that a player must have a contrarian view in at least two of the six races. Using the previously discussed ABCX approach, it is possible not to over-stake or poorly stake a bet which recognises the likelihood of most races being ‘chalky’ (i.e. the fancied horses making the frame) while still allowing for a less anticipated result which can make the bet.

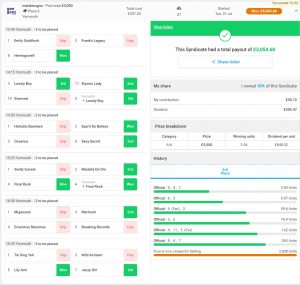

Here is an example of a Place 6 where the first race set things up. It was a small pot, a typical feature of my betting as it allows for the prospect of ‘scooping the pool’, that is, winning the lot.

The opening race on this Yarmouth card was a low grade 0-60 handicap with a couple of handicap debutants and the market heavily skewed towards a single runner. The unexposed three-year-old Herringswell won, at 10/1, on his first start in a handicap. He’d been third last time out over course and distance, beaten by half a length, so was hardly impossible to find.

As you can see from the green bars at the bottom right in the image, the result chopped the starting units from nearly 3,000 to little more than 250.

The next three legs all saw top of the market horses (favourite or second-favourite) place but in leg five, where I’d gone four horses deep, the two outsiders of six placed. That being said, Merhoob, my placed pick, was only 5/1 behind 3/1 joint-favourites, a 7/2 and a 9/2 shot.

Less than ten units went forward to the final leg, in which the third, fourth and joint-fifth-ranked horses in the market filled the places.

That left just 3.54 units to share the payout, of which my Syndicate ticket, which was a caveman play, comprised all of them. We shared over three thousand pounds. Again, I need to make the point that the winning odds. return vs stake, was ‘only’ 9/1.

This begs the question, is SP or the exchange a better bet?

Before placing a multi-race bet, or indeed any pool bet, we need to consider whether the return might be greater via another market medium. Specifically, will the SP (especially if Best Odds Guaranteed can be leveraged) or exchange accumulator pay more?

We obviously cannot know the answer to this in advance but, generally, in win pools betting theory it is prudent to stay close to the top of the market. As an example, if a 20/1 shot wins any race in the sequence I will almost certainly not have that runner selected. The reason is that, when multiplying the odds of the other five winners in a six-leg bet by 21 (20/1), it is somewhere between quite and very likely that the pool dividend will pay less than an SP or exchange accumulator bet on the same six races.

The exception to this rule is when there is a large Rollover or a highly liquid pool. For your average Redcar jackpot, however, we need to stay close to the head of the market, bet another way, or pass the opportunity altogether.

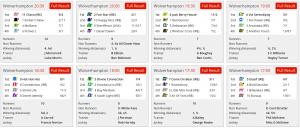

In the example below (5.00 to 7.30 races), there was a Rollover and the jackpot swelled to £30,000 for a Wolverhampton evening card. The SP accumulator paid £19,305 compared to a jackpot dividend of £20,153.20. But the Betfair SP accumulator paid £33,798. And the biggest priced winner in this sequence was 8/1.

The Betting Market

Market Rank vs. Market Price

One of the features of multi-race pools, more so than single race win markets, is the heavy domination of the top of the market. This is largely a function of poor staking, poor bankroll management and/or insufficient bankroll, whereas players who take one or two per leg (see part 1) rarely go beyond the third or fourth in the betting lists.

Moreover, when they do, it’s typically a ‘Hail Mary’ pick at big odds staked exactly the same as a short-priced runner. Clearly, this is heavily sub-optimal and is precisely what gives smarter punters their edge. Those longshots belong on a C ticket or in the bin, generally.

A good example of this was leg five in the above Yarmouth ticket. 83% of remaining units went out there even though a 5/1 shot was placed. He was 5/1 fifth-favourite of six and it was his market rank rather than his odds which blew most remaining ticket holders out of the pool.

Don’t deviate too far from the market

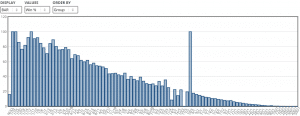

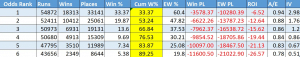

The market is generally right, or at least not far wrong. It is an excellent indicator of a horse’s chance, so much so that there is strong linearity between the two. This chart shows win strike rate by odds. Ignoring the price of 18/5, which has very little data and is the big outlier, this chart very well illustrates the robust relationship between price and win chance.

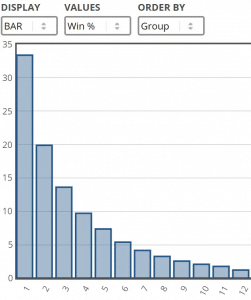

And this time by market rank, 1 being favourite, 12 being the twelfth in odds rank:

In Britain in the last five years, the favourite has won a third of all races, the favourite and second-favourite have collectively won a bit more than half of all races, and the first three in the betting have won two-thirds of all races.

Thus, in a random sample of six races, we might expect four of them, two-thirds, to be won by the first three in the betting. The further implication is that we may need to be looking further along the lists for a couple of the legs in a six-leg wager.

What does this mean in practice? It means that, across A’s, B’s and, usually in multi-race win pools only, C’s, you should have reasonable coverage of the top of the market; and, somewhere in the race sequence, you should be risking a few longer priced horses. However, this is usually in addition to, not at the expense of, the top of the market.

Steamers and Drifters in pools betting theory

This section should come with a wealth warning: drifters DO win!

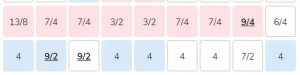

In case you’re not familiar with the terms, a ‘steamer’ is a horse being backed, usually showing with a blue background on odds comparison sites, while a ‘drifter’ is a horse which is weak in the market, usually with a pink background on odds comparison sites.

As a general principle, in races where form is fairly well established, I will note the market but follow my own form study. The exception is in bigger field handicaps where horses priced between 8/1 and 16/1 (approximately, not hard and fast) have taken notable support.

I tend to look at the markets in the morning and then again an hour or so before the first race, which is the time when I’m starting to frame my bets.

In the example above, where the second favourite is weak and the third favourite is strong (favourite not shown), assuming I could see a reason for this in their form, I would quite likely put both runners on B. If I couldn’t understand the weakness of the ‘pink’ runner, I’d probably play it on A.

There is quite a bit of ‘feel’ associated with this. Players need to get to know trainers and owners, too. For example, horses owned by J P McManus are often put in at defensive prices: odds which reflect the fact they might become subject to a gamble rather than which indicate the horse’s true form chance.

Horses owned by large or wealthy syndicates such as Elite Racing Club, Owners Group, or Highclere Thoroughbreds are often overbet. Consideration of the support for such runners needs to approached keeping in mind who might be backing it.

Equally, horses doing something notably different, their first time in a handicap, coming back from a layoff or stepping up/down markedly in trip, merit at least a second glance. Does the trainer have ‘previous’ in such a scenario? Is the horse bred for this extra distance?

Using Unnamed Favourites

This is a great tactic and one which is heavily under-utilised. It can be deployed in a number of different scenarios, of which these are just a couple.

Doubling up on A

Plenty of races, especially non-handicaps, have a very short-priced favourite and an obvious second-choice. Sometimes these races can be 10/1+ bar the front two. Depending on how the rest of your ticket looks – mainly, in how many other races you’ve got B and/or C picks – and how much bankroll you have, it can be a smarter play to double the favourite on A, rather than place the jolly on A and the ‘second in’ on B.

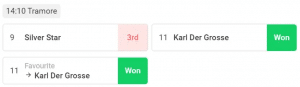

In this example, the favourite was Karl Der Grosse. He was 8/15 favourite, with Silver Star 4/1, Sweet Flight 5/1 and it was 16/1 and bigger the rest.

This was the first leg of a big rollover pool and I wanted the best chance of managing a profitable situation in the latter part of the sequence. So, rather than play the favourite as a banker, or put Silver Star on a B (or C) ticket, I went three deep on A, covering Karl twice (once with his racecard number and once as ‘Favourite’, unnamed favourite) and Silver Star once.

As can be seen, Karl Der Grosse won, which doubled the number of units the syndicate had running on to all subsequent legs. It cost three times as much as banking on the favourite, for two-thirds of the running-on equity (2/3 winning picks rather than 1/1 if just selecting Karl), but was the right play in the circumstances.

Extra pick on B (or C)

A tactic I sometimes use, although, to be brutally honest, I’m not certain that the maths support, is to play unnamed favourite on B or C. I do this in one of two situations, as follows:

– A weaker favourite that I like

Let’s say the favourite is around 2/1 or 5/2. Mathematically, and assuming that the market is correct and it is bet to a 100% overround [it’s not but go with it], this horse has a circa 30% chance of winning. If I think he’s value, as in he should be a little shorter, without necessarily feeling he’s a very likely winner like Karl Der Grosse above, I can play his racecard number on A and ‘unnamed favourite’ on B in addition to other contenders.

– Inscrutable handicap with multiple favourite contenders

I will quite often include FAV when I go five, six or seven deep in an impossible-looking handicap: it’s a degree of insurance against wide coverage being scuppered by a winning jolly. What I really want is for one of my longer-priced picks or, more correctly, one of the least-covered horses in the pool to win. But if the horse that the market ultimately sent off shortest wins, I will have all tickets containing that horse’s racecard number as well as any ticket containing FAV for that race.

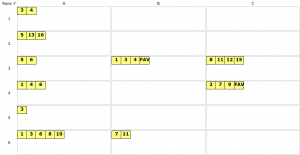

There were two races where I played variations of this tactic in an example I published in Part 1 of this mini-course, replicated below.

You can see the use of FAV in races 3 and 4. In race 3, I’d nominated the expected favourite on A, but I wanted to amplify him a little so added FAV to B and in race 4, where I had far less certainty about which horse would be sent off favourite, I didn’t want to lose my C investment because the jolly prevailed.

As it turned out, the favourite won race 3 and a C horse, not the favourite, won race 4.

Syndicates, Consolations and Cash Out in pools betting theory

Colossus Bets have three unique features which make varying degrees of appeal against the Tote.

Syndicates

The ability to create a Syndicate ticket means one’s bankroll goes further because, essentially, we are sharing the financial outlay as well as any return with other people. Alongside my personal bets, I create a lot of Syndicates on Colossus and we’ve had some fantastic paydays, the pick of which is shown towards the bottom of this post.

I started out taking only 10% of my Syndicate tickets, the minimum a Captain must take but now usually invest 50%, the maximum allowed.

Cash Out

Many of you will be familiar with the concept of Cash Out. My personal preference is to avoid Cashing Out a ticket if there are other insurance options available. I’ll talk about those in the Insurance section.

I have occasionally cashed out my stake on a ticket where there isn’t really a smart or cost-effective alternative to hedge the bet, but I tend not to.

Consolations

Consolations are like the curate’s egg: good in parts.

On the upside, players in a six-leg win pool will receive a dividend for getting five out of six or even four out of six. These can often cover the cost of what, at the Tote, would be a losing bet. They are good for cashflow and confidence.

However, the downside is that half of the ticket cost goes into the consolation pool, which means the base bet is twice as expensive as if there was no consolation pool.

On balance, I like the added aggression I feel I can play win pools with as a result of having that safety net. Even if I get the first race wrong, I’ve still got a chance of a return. That keeps players in the game and it’s a lot better for the soul than getting short-headed in the only race you didn’t have!

It always needs bearing in mind that one needs to halve the dividend for a £2 stake when comparing with a £1 accumulator (naturally).

Insurance

Insurance is a term for managing a position between the start and end of a multi-race bet in order to mitigate for the chance of a losing outcome. In other words, it’s a way of covering more eventualities than you have on your ticket, albeit at fractionally greater expense. As I’ve said, it is generally better to control the level of insurance you take rather than be dictated to by the cash out value.

There are a good number of insurance options, some of which are listed below.

Place lay

When betting a multi-race place pool, banking on the shortest priced horse in the sequence is normally a good strategy, unless you really don’t like it. Even then, it makes sense to try to overcome any prejudices you might have associated with the horse or its connections. Assuming you have banked on that runner to make the frame, you can then lay it for a place on an exchange.

An even money favourite would be around 1.2 (give or take) to lay on Betfair. If your placepot stake is £50, you can insure the bet for £10 or so. That makes your overall commitment £60 and needs to be factored into your P&L. I will usually place lay for less than my stake: if I think the horse is very likely to get placed I don’t want to spend what amounts to 20% of the ticket price buying insurance on one leg. But at the same time, I don’t want to lose my entire stake. So I might place lay to get half my money back for example.

Last leg options

If you’ve been smart and/or lucky enough to get to the final leg, you will have some options. Depending on the type of race, and whether it’s a win or place pool, the first option is to lay or place lay your pick. I would do that if I was on a short-priced runner as a banker.

Tricast

If you have, for instance, the top three in the betting in a six runner race, you can place tricast bets on the remaining trio. As with the actual multi-race bet itself, we should not be placing a combination tricast (three picks equals six bets), as that is not a smart way to stake. Supposing the unsupported runners were 6/1, 8/1 and 20/1, we might legitimately place a reverse forecast to the same stake on the first two; but our stake should be smaller on each of the shorter pair beating the outsider, and smaller still on the outsider beating either of the other two. We’re not looking for a ‘lucky’ payoff, we’re just covering our existing bet.

Calculating the insurance stake

To calculate how much insurance to take, work out the worst possible outcome in terms of a winning ticket.

Place 6

This involves creating a worst case scenario in terms of your dividend by adding together your selection with the most amount of total pool units placed on it, the unnamed favourite and the other best supported runners in the leg, up to the number of places available.

Adding all these units together on each of those together and dividing by the net pool (see Part 1 for gross and net) will produce the ‘worst case dividend’. This is the figure, multiplied by the number of lines you have, against which you should hedge/insure.

An example will help:

1 – 28.5

2 – 13

3 – 9.4

4 – 83 (F)

5 – 1.6

6 – 31

F – 12.5

Gross pool: 56,250 Net pool: 41,062.50

In this placepot example, the net pool is 73% of the gross pool. Let’s say we have horses 1, 2 and 4 in this six horse race and we currently have 80p lines running on to each of them.

Our worst winning result – two places in a six-horse race – would be:

46F (the two horses with most units remaining, plus unnamed favourite)

= 83 + 31 +12.5 = 126.5 winning units

The worst winning dividend would then be:

41062.5/126.5 = £324.60

of which we would have 80p for our one placed horse, #4.

We staked £100.

So our worst case dividend would be £259.68 in this example. That number, less our £100 stake, is what we would use to work out how much to hedge/insure for. Or we could just insure for our £100 stake.

Win pools

In a win pool, it often doesn’t make sense to lay selected runners, mainly due to the cash needed. In that case, it is better to back unsupported runners assuming there aren’t hordes of them.

Using our example race from above, where we have coverage of horses 1, 2, and 4, let’s say the net win pool is £100,000 and we have those same 80p lines running into the final leg, from a stake of £100.

The worst case winning (for us) dividend is if the favourite, #4, wins. That leaves 95.5 units and a dividend of

100,000 / 95.5 = £1,047.12

We’d have 0.8 x £1,047.12 = £837.70 representing a profit of £737.70 (less £100 stake).

Suppose the Betfair odds on the other runners are 3 – 22.0, 5 – 150.0, 6 – 7.4

So we might back

#6 for £80 @ 7.4 returns £592 (commission to deduct also)

#3 for £20 @ 22.0 returns £440 (ditto)

#5 for £2.50 @ 150.0 returns £375 (ditto)

We are now guaranteed at least £837.70 back if one of our three Win 6 selections wins; and a sliding scale, based on likelihood, of returns if one of our insurance bets wins.

If the favourite wins, we’d get

£837.50 – £102.50 (insurance bets) – £100 Win 6 stake = £635 profit

If the 150.0 outsider won, it would be a tough break, but at least we’d collect

£375 – £100 (losing insurance bets) – £100 Win 6 stake = £175 profit. On a ‘losing’ bet.

I’mconfident that I’ve made the art of hedging/insurance sound infinitely more complex in the above than it actually is. The key is to track your position and to know roughly where you are in terms of potential payout and how much of that you’re booked for. Pretty much all pool operators have ‘will pay’ pages on their website to show how much is running on to the next leg, and on which horses.

Often we’ll be in a losing position and insurance doesn’t really make sense. Occasionally we’ll be in a losing position and insurance will limit losses.

You’ll soon get the hang of working out where you are but only if you get into the habit of tracking the remaining units in the pool. Be Brave, There’s Always Tomorrow

Multi-race bets, especially win varietals, are not for the faint-hearted. They can involve excruciating close calls where the difference between a nose victory or defeat runs to thousands of pounds. The flip side of that is obvious: they can involve halcyon close calls when the verdict goes your way for a vast sum. That’s exciting!

The consolations offered by Colossus, albeit at the expense of a £2 ticket, are good value in terms of sanity, and they allow a player to display the one attribute above all others that is required to win in the multi-race jungle: bravery.

Over-staking is an affliction suffered by most Place 6 / win sequence punters: the fear of not ‘having it’ overrides the rationality of not diluting the value of the bet. As well as over-staking there is bad staking – placing the same faith in every pick on a ticket regardless of whether it’s 4/6 or 14/1.

If you can learn to overcome those two near-ubiquitous staking errors, you have a far better than average chance of catching big fish in these pools. Being brave also means acknowledging that, no matter how juicy the rollover or how tempting the guarantee today, there is always tomorrow.

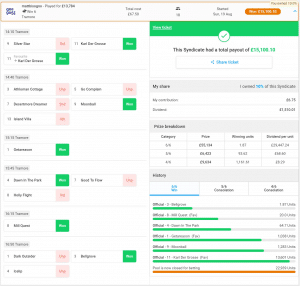

In closing, I want to share a ticket from a very good day. It was a syndicate play so plenty of others shared in this whopper of a dividend, which brought together a number of factors discussed in this second part. They include ABCX – this is the winning ticket, there were a bunch of losing/ consolation tickets as well; doubling the favourite; and insuring my personal position in the last leg (not shown here, but amounted to about £150).

The Ticket Builder

Throughout this two-part series, I’ve referred to ABCX methodology, and to a mechanical means of computing the part-permutations. The ticket builder, which is a little ‘rough and ready’ but is free for all to use, can be accessed here. Please do watch the video below before trying to use it!